stamp duty exemption malaysia 2019

On-the-road price without insurance for non-metallic models in Peninsular Malaysia for Individual Private Owners. This is subject to a minimum 10 discount by the developer and an exemption on the instrument of transfer is limited to the first RM1 million of the property price.

Real Property Gains Tax Rpgt In Malaysia 2022

This exemption however shall only be applicable with the HOC 2019 Certification issued by REHDA SHAREDA or SHEDA.

. Instruments of transfer and loan agreement for the purchase of residential homes priced between RM300000 to RM25 million will enjoy a stamp duty exemption. This is effected under Palestinian ownership and in accordance with the best European and international standards. 2 Order 2019 PU.

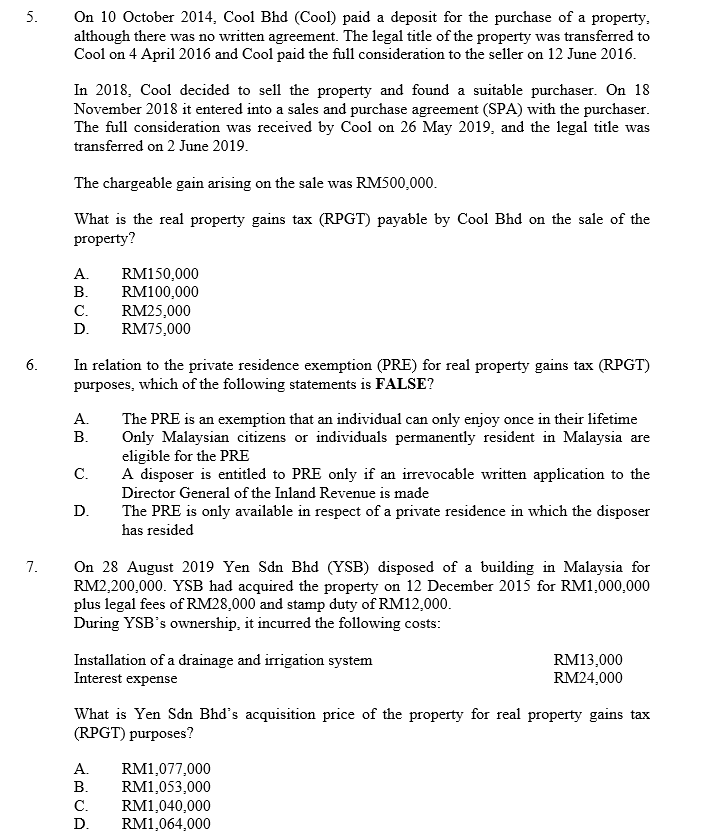

Our experienced journalists want to glorify God in what we do. Toyota Dream Car Art Contest. Stamp Duty Exemption on Memorandum of Transfer.

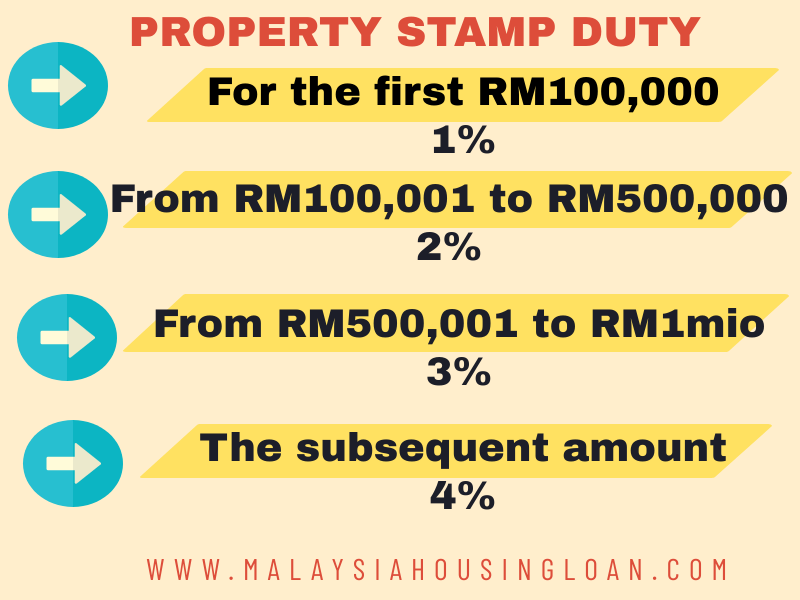

RM100001 To RM500000 RM6000 Total stamp duty must pay is RM700000 And because of the first-time house buyer stamp duty exemption you can apply for the stamp duty exemption. It is a geographic area where goods may be imported stored handled manufactured or reconfigured and re-exported under specific customs regulation and generally not subject to customs duty. 4250 housing units worth RM358mil will be built under the Rumah Mesra Rakyat program.

Stamp Duty Exemption No. KUALA LUMPUR Oct 7. Sometimes a property can be held in a family trust or through a superannuation trust but strict rules apply.

The 100 stamp duty exemption for first-time homeowners remains applicable for properties priced RM500000 and below through the Keluarga Malaysia Home Ownership Initiative i-Miliki initiative from June 1 2022 to December 2023. Stamp duty is charged on the transfer of shares and certain securities at a rate of 05 percent. EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms.

For First RM100000 RM1000 Stamp duty Fee 2. The Real Estate and Housing Developers Association of Malaysia Rehda has appealed to the government to consider extending the 75 stamp duty exemption to all buyers and not just first-time house buyers. Employees Exempted From the Coverage of the Employees Social Security Act 1969 Are as.

ASCII characters only characters found on a standard US keyboard. Stamp duty Fee 1. Modernised versions of stamp duty stamp duty land tax and stamp duty reserve tax are charged respectively on the transfer of real property and shares and securities at rates of up to 4 percent and 05 percent respectively.

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount. The buyer will be entitled for a stamp duty exemption for the MOT and only need to pay a nominal fee of RM10 provided. Courthouse Administration Building 400 S.

Must contain at least 4 different symbols. New foreign workers entering Malaysia on or after 1 January 2019 have to register with SOCSO once they are validated by the Immigration Department of Malaysia at any gazetted port of entry. A free-trade zone FTZ is a class of special economic zone.

Stamp duty exemption on instrument of agreement for a loan or financing in relation to a Micro Financing. Its actions were for the most part concerned with measures to establish a new national government for the Southern revolution and to prosecute a war that had to be sustained throughout the existence of the. Free trade zones are generally organized around major seaports international airports and national frontiersareas with.

Stamp Duty Exemption No. 2 Order 2019 Amendment Order 2019 PU. The Actual Calculation of Stamp Duty is before first-time house buyer stamp duty exemption.

As with any sale of land the purchaser normally has to pay stamp duty and depending on the type of property the person selling may have to pay capital gains tax DCruz explains. A 173 for purchase of property directly from a property developer. Stamp duty exemption on loanfinancing agreements executed from 1 January 2022 to 31 December 2026 between MSMEs and investors for funds raised on a peer-to-peer P2P platform registered and recognised by the Securities Commission Malaysia.

This Order comes into force on 01012021. 6 to 30 characters long. The Confederate States Congress was both the provisional and permanent legislative assembly of the Confederate States of America that existed from 1861 to 1865.

It will benefit a wider pool of buyers especially the upgraders said Rehda president Datuk NK Tong. A 81 Stamp Duty Exemption No. Subsequent Monthly Charges 35 months.

In the latest Stamp Duty Exemption Order 2021 PUA 53 on instrument of transfer such as Memorandum of Transfer MOT. A full stamp duty exemption is given on. American Family News formerly One News Now offers news on current events from an evangelical Christian perspective.

Smart Floor Lamp Meross Smart Home Devices Msl610

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties

5 Hike In Real Property Gain Tax Rpgt In Malaysia 2019 Kclau Com

Most Important Stamp Duty Exemptions For Holding And Subsidiary Companies

Newsletter 31 2019 Stamp Duty Exemption No 2 3 Order 2019 Page 001 Jpg

Tax Changes In Malaysia S 2022 Budget

Stamp Duty Waiver For First Time Purchases Of Houses

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties

Peps Malaysia Stamp Duty Exemptions Criteria Savings Follow Peps Malaysia Facebook Page To Get Experts Insights On Property In Malaysia Stampdutymalaysia Pepsmalaysia Propertytaxmalaysia Facebook

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Solved 5 On 10 October 2014 Cool Bhd Cool Paid A Deposit Chegg Com

Should You Buy A Hoc Project Consider These Pros And Cons

2019 Malaysia Personal Income Tax Exemptions Comparehero

China Clarifies Duty Exemption Policy For Foreign Investment In Encouraged Industries

Property Law In Malaysia Stamp Duty For Transfer Of Property Chia Lee Associates

Budget 2019 11 Highlights That Will Affect The Property Market

0 Response to "stamp duty exemption malaysia 2019"

Post a Comment